Mass meals tax, an issue that has sparked discussions international, is a type of taxation levied at the intake of meals pieces. This tax has been applied in more than a few paperwork, with various motivations and affects. On this article, we delve into the intricacies of mass meals tax, inspecting its varieties, implications, and moral issues.

From value-added taxes (VAT) to gross sales tax, several types of mass meals taxes exist, each and every with its personal mechanisms and penalties. Working out those permutations is an important for policymakers and shoppers alike.

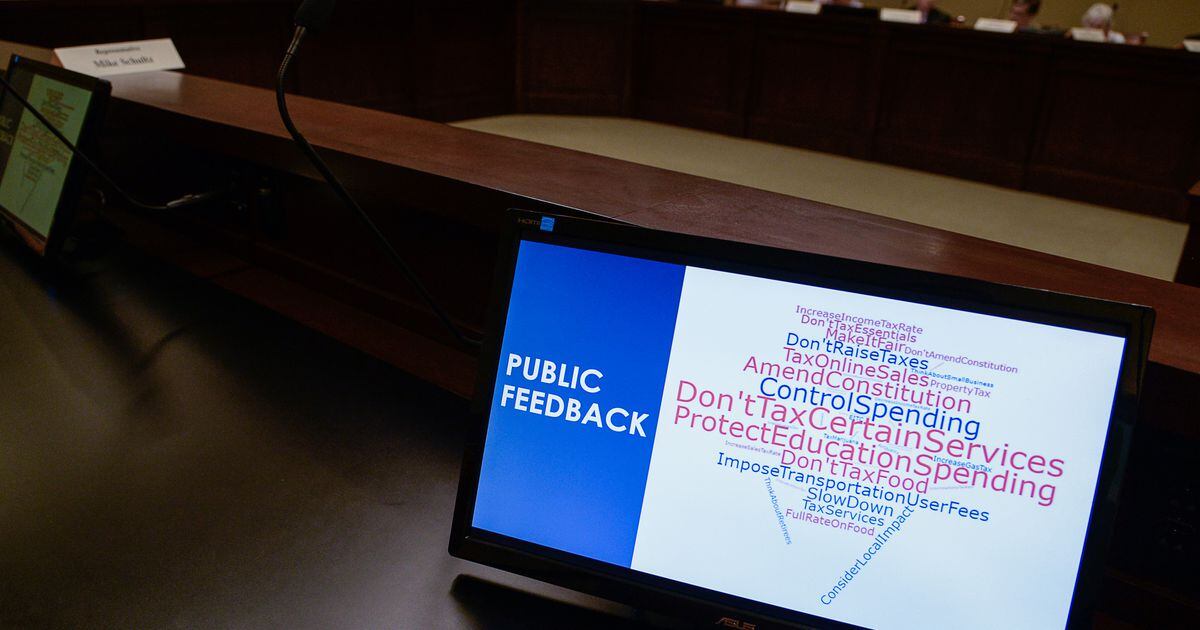

Selection Approaches to Meals Taxation

Past a common meals tax, choice approaches to meals taxation exist, each and every with its personal benefits and downsides.

One choice manner is focused subsidies. Relatively than taxing all meals, focused subsidies supply monetary help to low-income families or folks to buy wholesome meals choices. This manner guarantees that the ones maximum in want have get entry to to nutritious meals whilst minimizing the affect at the general meals provide.

Nutrient-Primarily based Taxes

Some other choice manner is nutrient-based taxes. Those taxes particularly goal meals top in dangerous vitamins, equivalent to saturated fats, sugar, or sodium. Through expanding the price of those meals, nutrient-based taxes discourage their intake and advertise more fit alternatives.

- Benefits:Nutrient-based taxes can successfully cut back the intake of dangerous meals, resulting in advanced public fitness results.

- Disadvantages:They are able to be advanced to put in force and would possibly disproportionately affect low-income families who depend on more economical, processed meals.

Global Views

Globally, a lot of international locations have applied mass meals taxes, providing insights into their effectiveness and courses realized.

One notable instance is Denmark’s “fats tax,” imposed in 2011. The tax objectives meals with top ranges of saturated fat, aiming to advertise more fit alternatives. Whilst first of all met with resistance, it has since been credited with lowering the intake of dangerous fat through 10%.

Courses Realized

- Taxes must be moderately designed to reduce accidental penalties, equivalent to transferring intake to untaxed, similarly dangerous choices.

- Public schooling and consciousness campaigns are an important for the luck of mass meals taxes.

- Earnings generated from taxes can be utilized to beef up health-related projects, additional selling wholesome alternatives.

Very best Practices

- Taxes must be in response to purpose dietary standards, specializing in meals top in dangerous fat, sugar, or salt.

- Taxes must be applied steadily to permit shoppers to regulate their intake behavior.

- Governments must collaborate with meals producers to scale back the supply of dangerous meals and advertise more fit choices.

Moral Issues

Mass meals taxes carry moral considerations that will have to be moderately regarded as. Those taxes have the possible to affect fairness, affordability, and the elemental proper to meals.

Fairness

Mass meals taxes can disproportionately have an effect on low-income families. Those families spend a bigger share in their revenue on meals, making them extra prone to value will increase. Moreover, low-income families frequently have restricted get entry to to wholesome and reasonably priced meals choices, making it more difficult for them to regulate their diets in accordance with upper meals costs.

Affordability

Mass meals taxes could make wholesome meals much less reasonably priced for all shoppers. This will have unfavorable penalties for public fitness, as get entry to to nutritious meals is very important for well-being. Upper meals costs can result in higher meals lack of confidence, the place folks and households battle to acquire ok meals.

Proper to Meals

Mass meals taxes too can carry considerations about the suitable to meals. The United International locations acknowledges the suitable to meals as a basic human proper. This proper contains the facility to get entry to ok, protected, and nutritious meals. Mass meals taxes that make meals much less reasonably priced or obtainable may just doubtlessly violate this proper.

Implementation Demanding situations: Mass Meals Tax

Mass meals taxes provide more than a few implementation demanding situations, together with administrative complexities, compliance problems, and attainable loopholes that wish to be moderately addressed to make sure efficient implementation and fulfillment of supposed targets.

One of the crucial key demanding situations is the executive burden related to enforcing a mass meals tax. This contains the desire for powerful monitoring and tracking programs to make sure correct tax assortment and save you evasion. Moreover, figuring out the suitable tax charges for various meals pieces is usually a advanced procedure, requiring cautious attention of dietary price, affordability, and attainable accidental penalties.

Compliance Problems

Compliance with mass meals taxes will also be difficult, specifically for small companies and folks with restricted sources. The complexity of tax rules and the possibility of consequences can create a disincentive for compliance. Additionally, the casual nature of meals markets in lots of growing international locations could make it tough to put into effect tax assortment.

Attainable Loopholes

Loopholes and exemptions in mass meals taxes can undermine their effectiveness and result in inequitable results. For instance, exemptions for positive meals pieces or companies can create alternatives for tax avoidance and cut back the total affect of the tax. Moreover, the definition of “dangerous” meals can also be subjective and open to interpretation, doubtlessly resulting in inconsistencies in tax utility.

Coverage Suggestions

To put in force efficient and equitable mass meals taxes, policymakers must believe the next suggestions:

Taxes must be designed to focus on dangerous meals whilst minimizing the affect on wholesome choices. This can also be completed thru tiered tax charges in response to dietary content material, equivalent to sugar, saturated fats, and sodium.

Mitigating Detrimental Affects

To mitigate attainable unfavorable affects on low-income families, governments may give tax credit or subsidies for wholesome meals purchases. Moreover, focused vitamin teaching programs can lend a hand shoppers make knowledgeable alternatives and cut back the total intake of dangerous meals.

Maximizing Advantages, Mass meals tax

To maximise the advantages of mass meals taxes, revenues must be earmarked for public fitness projects, equivalent to vitamin schooling, weight problems prevention techniques, and infrastructure enhancements that advertise wholesome consuming.

Clarifying Questions

What are the principle motivations for enforcing a mass meals tax?

Mass meals taxes can also be motivated through more than a few elements, together with elevating earnings for public services and products, selling more fit meals alternatives, and lowering the environmental affect of meals manufacturing.

How does a mass meals tax affect shopper conduct?

Mass meals taxes can affect shopper conduct through guaranteeing meals costlier, doubtlessly resulting in shifts in buying patterns and intake behavior.

What are the possible distributional penalties of a mass meals tax?

Mass meals taxes will have distributional penalties, as they are going to disproportionately have an effect on low-income families and prone populations who spend a bigger proportion in their revenue on meals.